Singapore industrial: a bright spot in commercial real estate

AMID the current backdrop of higher interest rates and heightened uncertainty, industrial assets in Singapore have stood out as a bright spot in commercial real estate. There are a few reasons for this.

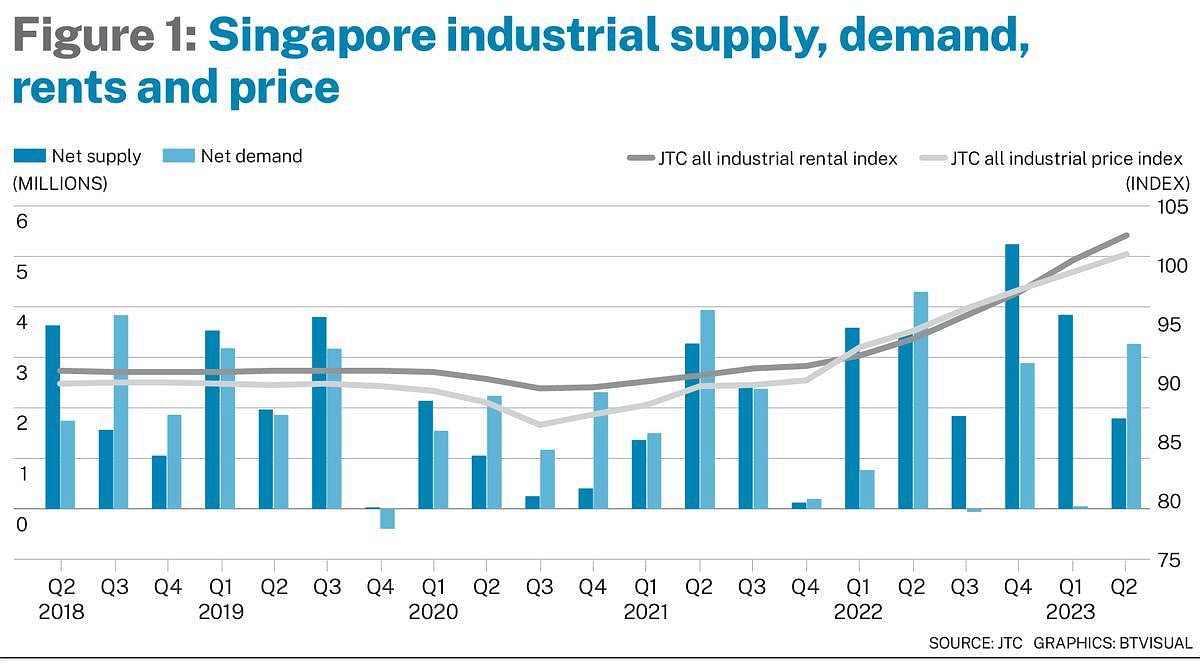

Firstly, construction delays during the pandemic have resulted in supply lagging demand, leading to the strong growth in rents and prices (Figure 1).

The JTC All Industrial price and rental indices have maintained their eleventh consecutive quarter of growth during Q2 2023, reaching their highest levels since Q1 2016 and Q1 2015 respectively.

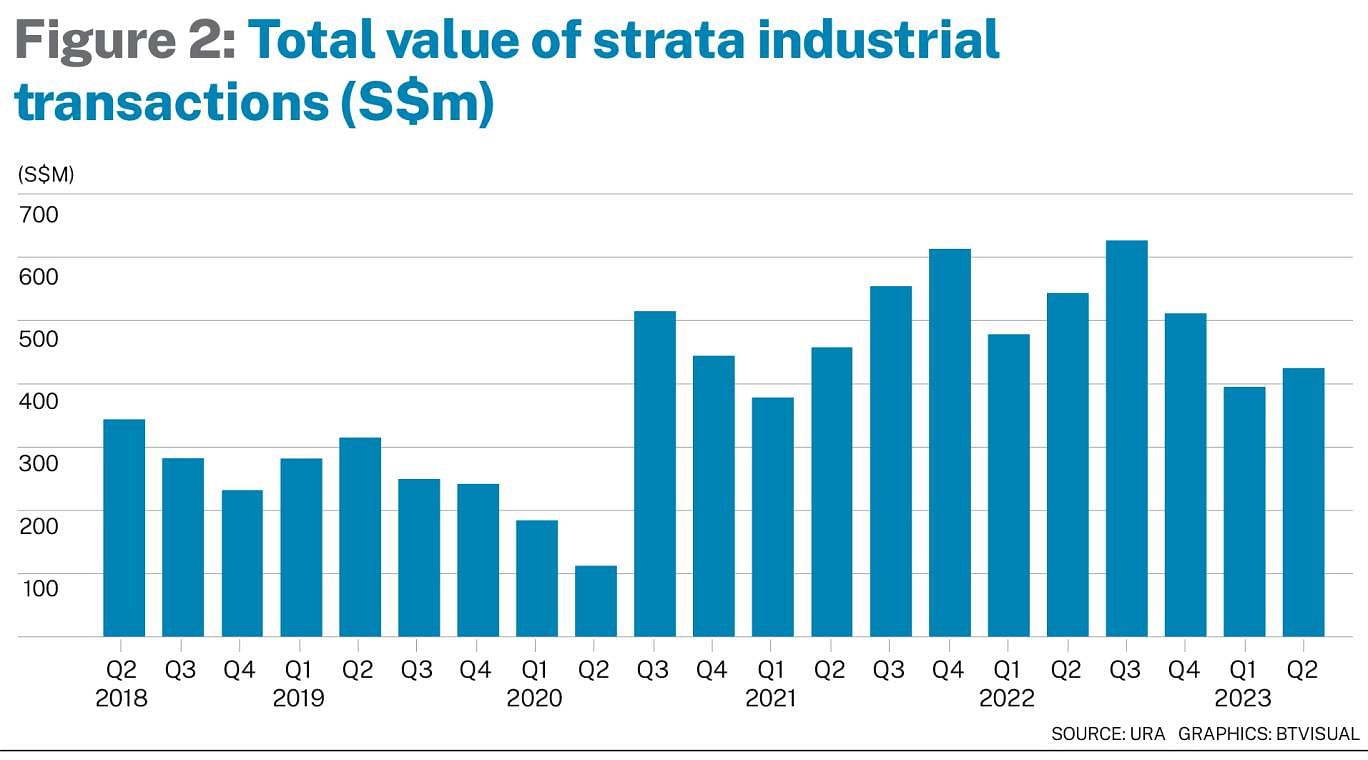

The shortage, together with the punitive Additional Buyer’s Stamp Duty (ABSD) imposed on Singapore residential properties, has redirected some investor interest from residential to commercial real estate, including industrial assets. As shown in Figure 2, strata industrial volumes have seen an uptick and been robust since the depths of the pandemic in Q2 2020.

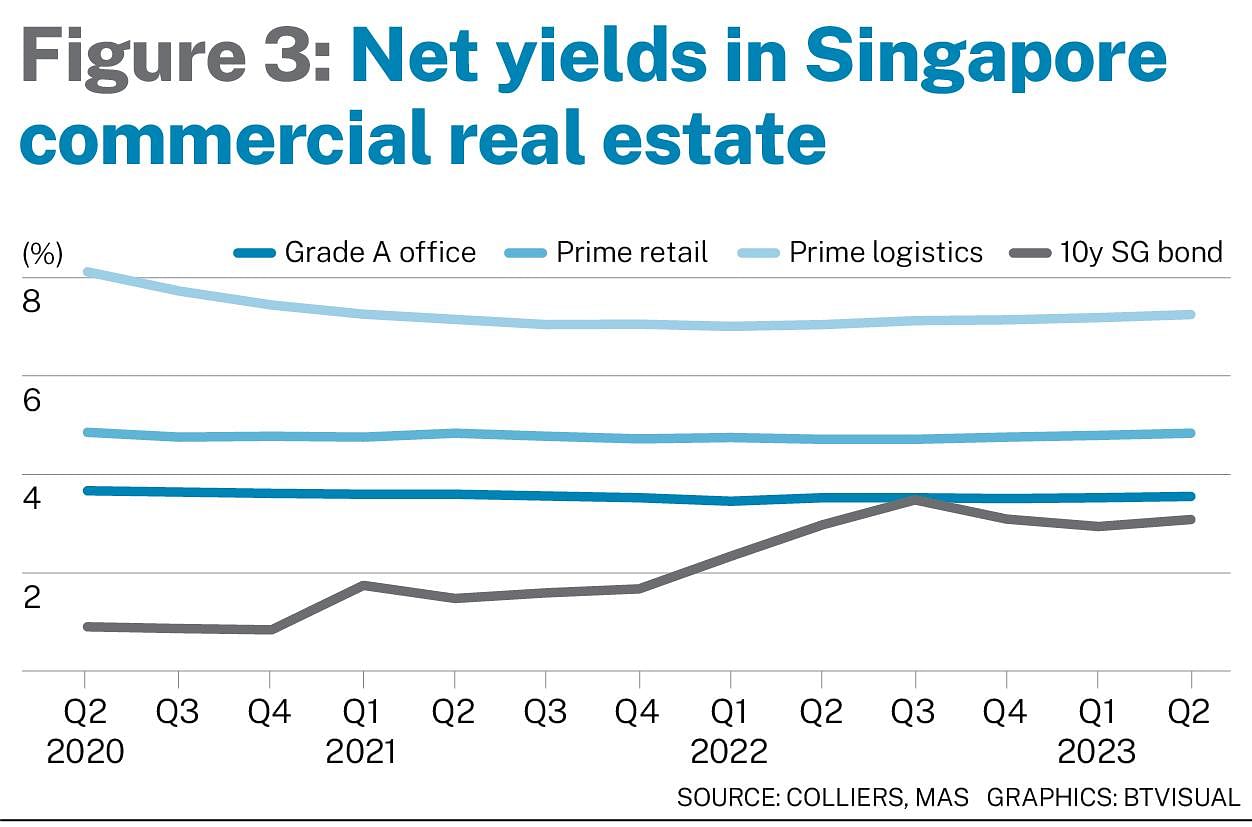

Finally, as shown in Figure 3, industrial property (represented by prime logistics) is the only sector that can provide higher spreads over the risk-free rate (represented by the 10-year Singapore Government Bond).

Warehouses – the brightest spot

One of the key drivers of this strong growth momentum in overall industrial rents is the warehouse segment.

While overall industrial rents have grown by 14.5 per cent since their trough in Q3 2020, the warehouse segment has outperformed, growing by 15.9 per cent in the same period.

With supply catching up, firms have more options with newer warehouses better suited for automation and modern logistics.

These newer facilities usually command rents at a premium over the market average and naturally nudge rents upwards.

Suppliers to manufacturers opening production facilities with the goal of diversifying their supply chain are also taking on warehouse space, helping to replace the demand from e-commerce players as consumers switch their spending from goods (such as e-commerce) to services (such as dining, travel and concerts).

The overall market for private warehouse space remains tight by historical standards, with availability below pre-pandemic levels.

For example, even though the 8.5 per cent vacancy in Q2 2023 was higher than the 7.8 per cent set in Q4 2022 (the tightest post-pandemic), it is still well below the 10.1 per cent average vacancy for the past five years.

In particular, prime logistics assets are limited in supply and almost at full capacity. Only a handful of facilities are expected to come onstream by end-2025, and these have already seen enthusiastic pre-commitment rates.

Performance is asset-specific

It has been suggested that new economy industrial assets which include high specification factories, business parks, and data centres are poised to ride on the tailwinds of structural trends such as digitalisation, and the increasing prevalence of automation and technology. However, not all these assets can outperform.

The recent contraction in the technology sector means some occupiers have been reducing their footprints or optimising their space at office-grade factories and business parks.

Further, there will be a surfeit of 4.5 million square feet of business park space up till 2025 (an average of 1.5 million sq ft a year, compared to 0.5 million sq ft per year in the past five years).

Out of this, business park spaces in the Punggol digital district and parts of the revamped Singapore Science Park will make up over 4.1 million sq ft.

Within this segment, there is a distinct bifurcation which shows how occupiers prefer city fringe properties, with higher rents and tighter vacancies in these sectors than those further out on the island.

With the advent of Industry 4.0, where the emphasis is on efficiency and optimisation, facilities that are better suited for automation and have energy efficiency features will be favoured by occupiers and investors.

Therefore, it is no surprise that some older assets have already been taken off the market to be upgraded to suit these needs, with more likely to follow suit.

As well, the popularity of generative AI has thrown data centre development in the spotlight.

Following the three-year moratorium on new builds, four operators have been provisionally awarded 80MW of new capacity. Given their time to market and overwhelming demand, this new supply is likely to be snapped up, leaving vacancy still tight and rents elevated.

Hence, there are also opportunities for investors and operators to meet this demand by developing ancillary data centres in nearby secondary markets, such as Johor and Batam.

The shine might not last

A look at the upcoming ramp-up in supply within the industrial sector shows that with the remaining supply of 6.7 million sq ft in 2023, and an average of 10.1 million sq ft from 2024 till 2026 (compared to an average of 8.4 million sq ft in the past three years during the pandemic), higher supply will moderate rental and price growth in the near term but may also provide more options for occupiers.

Notably, the lack of new warehouse space after 2025 might fuel the continued growth in warehouse rents, especially in the prime logistics space where the limited supply means vacancy remains tight. In addition, the weaker macroeconomic environment from tighter credit conditions remains an overhang on the sector.

Higher cost of capital has led to widespread caution, while Singapore’s industrial indicators have been in a slump, largely driven by a weaker manufacturing outlook and slowdown in the semiconductor cycle.

Besides, as prices and rents in the various real estate sectors recalibrate to current conditions, and as higher industrial rents are met with resistance, industrial assets, despite being a staple in most real estate portfolios, might eventually lose their shine.

Industrial – a long-term pillar for Singapore and the region

Nevertheless, demand for well-located, modern and efficient assets will continue to prop up the industrial market, underpinned by sustained demand from the advanced manufacturing, logistics, biomedical, as well as food sectors.

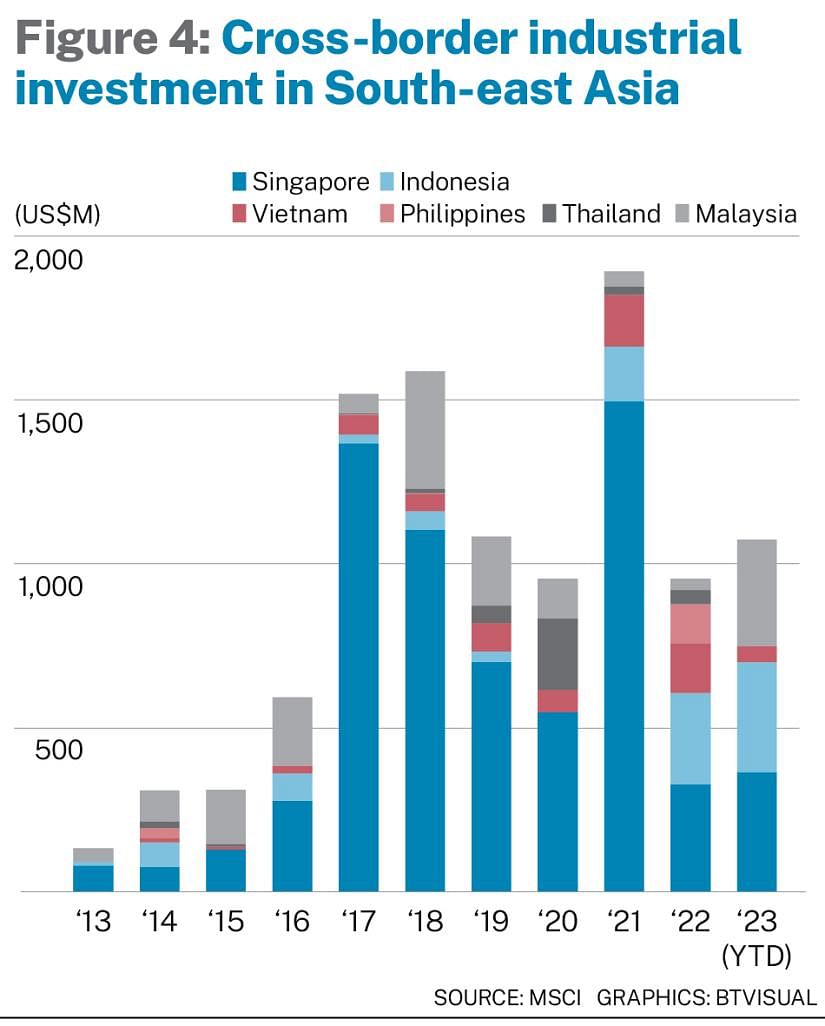

Within the South-east Asian region, despite its size, Singapore remains the top destination for cross-border industrial investments (Figure 4) with its stability, connectivity, infrastructure and support that the government provides.

Trade tensions have also resulted in industry players looking to fortify or diversify their supply chains, with some looking to set up their regional hub in Singapore, thereby continuing to support industrial demand in the long term.

Catherine He is head of research, Singapore and Lynus Pook is executive director, industrial services, Singapore, at Colliers