After S$160 million makeover, SingLand eyes better take-up, higher rents at Singapore Land Tower

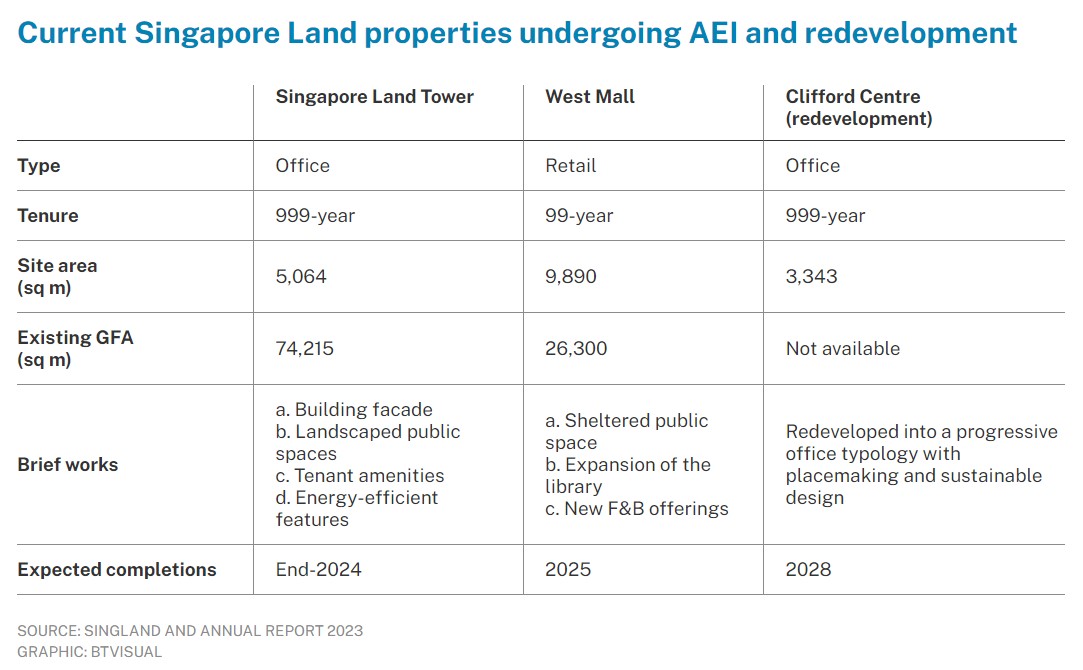

(SingLand) will complete a major upgrade of its iconic Singapore Land Tower by the end of 2024, after three years of extensive asset enhancement works. Built in 1980, the 47-storey building in the Central Business District (CBD) will see more lush green spaces, energy-efficient features, a double-glazed facade and new tenant amenity spaces after completion.

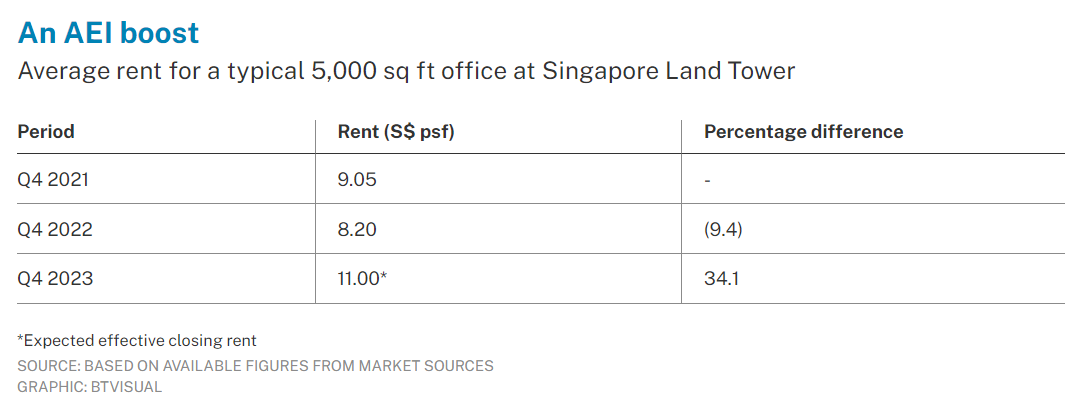

The S$160 million asset enhancement initiative (AEI) already appears to be paying off. Between the fourth quarter of 2021 and Q4 2023, rents in the building have risen, checks by The Business Times found.

Based on Colliers’ basket of properties, the average monthly rent for Grade A CBD office space rose 0.7 per cent quarter on quarter to S$11.57 per square foot (psf) in the first quarter of 2024.

According to market sources, a typical 5,000 square feet (sq ft) space at Singapore Land Tower would have fetched S$11 psf per month on average in Q4 2023, 34 per cent higher than in the year-earlier period. Current listings on PropertyGuru also show smaller spaces asking for up to S$12 to S$13 psf.

Singapore Exchange-listed SingLand started works at its 999-year leasehold property in 2021, not long after a corporate revamp transformed United Industrial Corp into Singapore Land Group. At the time, the company said that it was looking to optimise its portfolio, which included “Grade-A location, but Grade-B quality” assets.

In a recent interview via e-mail with BT, SingLand chief executive Jonathan Eu said: “The asset enhancement initiatives will also set a new industry benchmark of how older properties can retain their existing structure, and yet evolve to meet the changing demands of the workforce.”

The AEI is partly funded by proceeds from a S$100 million green loan from UOB and DBS.

AEIs are intended to drive net property income, which in turn increases the property’s value, said Melvin Chay, Colliers Singapore’s director for capital markets and investment services.

Alan Cheong, Savills Singapore’s executive director for research and consultancy, said: “For offices, the flight-to-new-buildings syndrome is forcing landlords of older buildings to upgrade or else they may lose existing tenants and/or be unable to raise rents when they search for new or replacement tenants.” Post-AEI, office spaces can command up to 25 per cent above their previous rents, for both Grade A and Grade B buildings in the CBD, he said.

Alice Tan, Knight Frank Singapore’s head of consultancy, noted: “The target uplift in gross rental rate ranges from 9 to 20 per cent subject to the net lettable area and tenant mix changes.” The downside, however, is that any major renovation is disruptive to tenants, she added.

Indeed, in the first year of its AEI works, SingLand reported in August 2022 that revenue from property investment fell by S$8.3 million or 6 per cent, mainly due to non-renewals of leases due to the works at Singapore Land Tower.

But, SingLand has managed to retain a majority of its tenants at Singapore Land Tower since the start of the AEI in 2021, the company has said. At the end of 2023, committed occupancy for the building stood at 74 per cent, compared with 65 per cent in 2022.

The exercise will lift gross floor area (GFA) by 2.2 per cent or about 1,614 square metres (sq m), bringing total GFA to 75,829 sq m. The limited increase in allowable GFA would not have justified a “complete demolish and rebuild” for Singapore Land Tower, Eu said.

Instead, the developer chose to keep the building operational during the AEI process. This helped SingLand to not only serve existing tenants, but also progressively upgrade spaces and market an improved product to prospective tenants.

“This had a significant influence on the commercial viability of the project,” Eu noted.

Where GFA has already been maximised, building owners can reconfigure layout to increase efficiency, such as by repurposing dead space, said Colliers’ Chay. They can also raise overall net property income by cutting up a single office floor plate for multi-tenant use, which lowers net lettable area (NLA) but raises rents, he added.

Besides the adaptive re-use of space, building owners are also being driven to undertake AEIs due to environmental, social and governance (ESG) requirements.

For Singapore Land Tower, sustainability was a key consideration. Taking the refurbishment approach was more sustainable, “as demonstrated in an embodied carbon study we conducted, which showed that we were able to avoid over 50 per cent of embodied carbon emissions by adopting an AEI instead of the conventional demolish and rebuild approach”, elaborated Eu.

While the latest Urban Redevelopment Authority (URA) data showed that Central region office rents fell 1.7 per cent in Q1 after climbing for nine quarters, Eu remains confident that the AEI for Singapore Land Tower will help it achieve a positive take-up rate, by focusing on “creating vibrant and sustainable spaces that cater to the specific needs of the community they serve”.

SingLand is also working on several other projects in its portfolio.

For Clifford Centre, which was completed in 1977, redevelopment was the only way to intensify potential, said Eu. The new building will offer over 500,000 sq ft of commercial and retail space, working out to a GFA uplift of about 34 per cent, he added. SingLand declined to reveal the cost of the redevelopment.

SingLand also received provisional planning permission from the URA last year for a partial redevelopment of Marina Square. Marina Square, a 99-year leasehold development that opened in the 1980s, sits on a 92,197 sq m plot with total GFA of 315,046 sq m.

Besides a five-storey retail mall, the site also houses three hotels – Pan Pacific Singapore, Parkroyal Collection Marina Bay and Mandarin Oriental. Part of the site is to be rezoned from “hotel” to “residential with commercial at first storey”. The timeline for the project has not been determined.

On why SingLand picked the redevelopment route for Marina Square, Eu explained: “While AEIs offer a more sustainable way to upgrade existing buildings, they are not without challenges.

Careful evaluation needed

“A careful evaluation of the existing building is necessary to determine whether it has a good base structure that allows for intensification and enhancements. It is also important to consider whether it will be feasible to keep the building live while carrying out the AEI works to minimise the level of disruption to our tenants,” he said.

UOL Group’s chief operating officer Neo Soon Hup noted that although retail malls face higher volatility in tenant retention, AEIs can be useful to improve layouts and capitalise on underutilised spaces so as to optimise the trade mix and enhance offerings. “Experienced retailers usually welcome the idea of a rejuvenated mall with better amenities,” he added.

In the third quarter of last year, City Developments Ltd (CDL) commenced a S$50 million upgrade at its City Square Mall, with completion expected in the second quarter of 2024 for phase one and the first half of 2025 for phase two.

The AEI will add about 26,000 sq ft of NLA to the mall via bonus GFA. The space under the first phase was 95 per cent leased as at the end of last year, CDL said.

Another mall landlord, Frasers Property, will complete its S$38 million AEI for Tampines 1 in Q3 this year. It will add about 8,000 sq ft of NLA from various bonus GFA schemes to the mall.

“Approximately 8 per cent of return on investment with value generation from higher rents, asset valuation gains and sustainable asset performance” would be achieved for the mall after completion, Frasers Property said in a business update last January.

And CapitaLand Investment recently reopened CQ @ Clarke Quay, after a S$62 million AEI.