Former Cecil House office building up for sale

An 11-storey office building on Cecil Street is up for sale at an indicative price of S$210 million.

The property at 139 Cecil Street, formerly named Cecil House, sits on a 99-year leasehold land site of approximately 7,936 square feet.

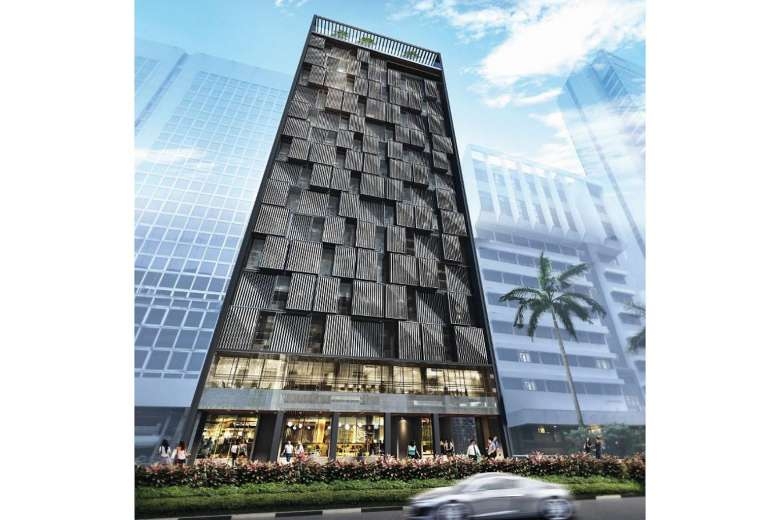

The office block is currently vacant, and the owner intends to re-develop it into a new 16-storey boutique commercial building with office space, ground-level food and beverage outlets and car park facilities, according to a press release pn Monday (April 24) from its sole marketing agent, Cushman &Wakefield, launching an expression of interest exercise.

The new total leasable floor area is estimated to be 85,000 square foot and will comprise a communal roof terrace with a swimming pool, gym, jacuzzi and outdoor dining.

The re-development is expected to be completed by the second quarter of next year.

It was reported last year that a Chinese buyer had paid for a 60 per cent stake in the company which owns 139 Cecil Street. The remaining stake is owned by a joint venture between Vibrant Group, which is listed on the Singapore Exchange, and DB2 Group.

Mr Shaun Poh, executive director of capital markets at Cushman & Wakefield said that the sale was " a great opportunity for investors to acquire en bloc a rare and sizable office building along the coveted Cecil Street in the heart of Singapore's central business district."

He added that the timing of the expected completion of the re-development would be "ideal" for investors looking to ride on the anticipated office market upswing by mid-2018.

Analysts say that investors' semtiment towards the office sector seems to have improved, after a period of oversupply and softening rents in the Singapore office market.

CBRE's managing director of advisory and transaction services Moray Armstrong said last month that "it looks likely that after a period of market softening that has spanned over two years, rents may soon find support levels and at a level slightly above previous forecast."

"Going forward with relatively few new office projects scheduled through the next two to three years, the conditions for a return to rental growth are developing. This has not been lost on the investor community and Singapore is attracting strong buying interest," he added.