Office market deals pick up

The office market is now abuzz, as sentiment has swung from pessimism to optimism in just one year. Fears of an oversupply in the office market 18 months ago have evaporated, with investors now forecasting a period of relatively modest supply in 2018 to 2020. Jeremy Lake, CBRE executive director of capital markets, observes: “Singapore goes through periods of too much office space, and then periods of relative shortage.”

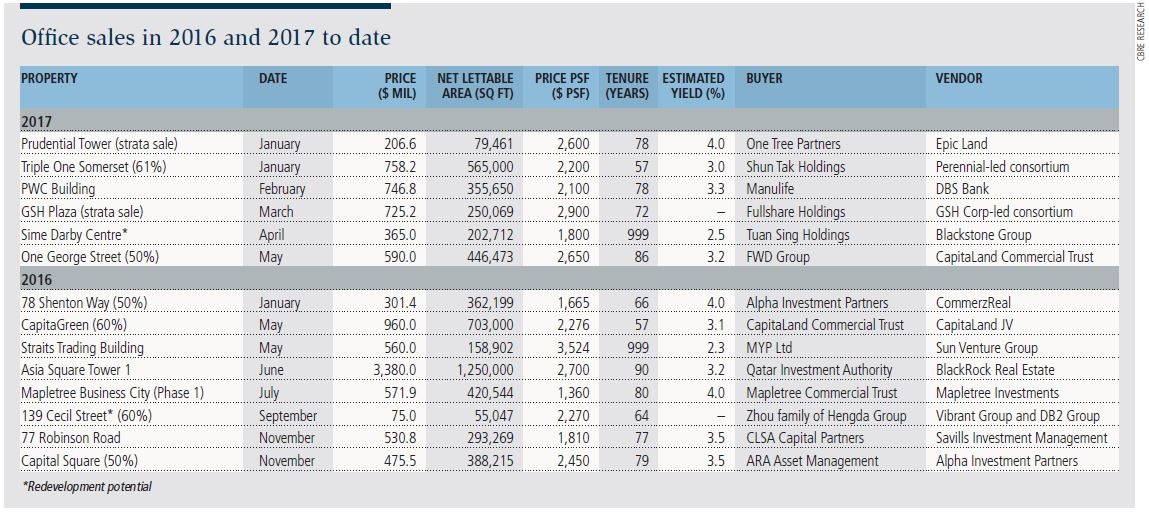

In the first four months of 2017, $3.39 billion worth of office deals were transacted. They include deals valued above $100 million, ranging from the sale of substantial strata space to stakes in a building or an entire building. The latest office deal done early this month was the sale of a 50% stake in Grade-A office building One George Street for $590 million ($2,650 psf). The buyer was FWD Group, the insurance arm of investment vehicle Pacific Century Group, controlled by Richard Li, the younger son of Hong Kong’s richest tycoon Li Ka-shing.

CBRE brokered four of the six office deals done so far this year, amounting to $1.91 billion, or 56% of the total $3.39 billion transacted. This includes the sale of the 50% stake in One George Street and DBS Bank’s entire interest in the holding company of PWC Building to an indirect subsidiary of Manulife Financial Corp for $746.8 million, considered one of the biggest office deals in 1Q2017.

The two other office deals brokered by CBRE this year were the sale of Sime Darby Centre to Tuan Sing Holdings for $365 million; and the sale of 79,500 sq ft of strata space in Prudential Tower to private-equity firm, One Tree Partners, for $206.6 million (see table).

The remaining two office deals that CBRE was not involved in were direct deals between the vendors and buyers. One was the sale of the entire interest in Plaza Ventures Pte Ltd — the registered owner and developer of GSH Plaza — to Fullshare Holdings for $725.2 million. The other direct deal was the sale of the 61% stake in Triple One Somerset to Hong Kong-listed Shun Tak Holdings for $758.2 million.